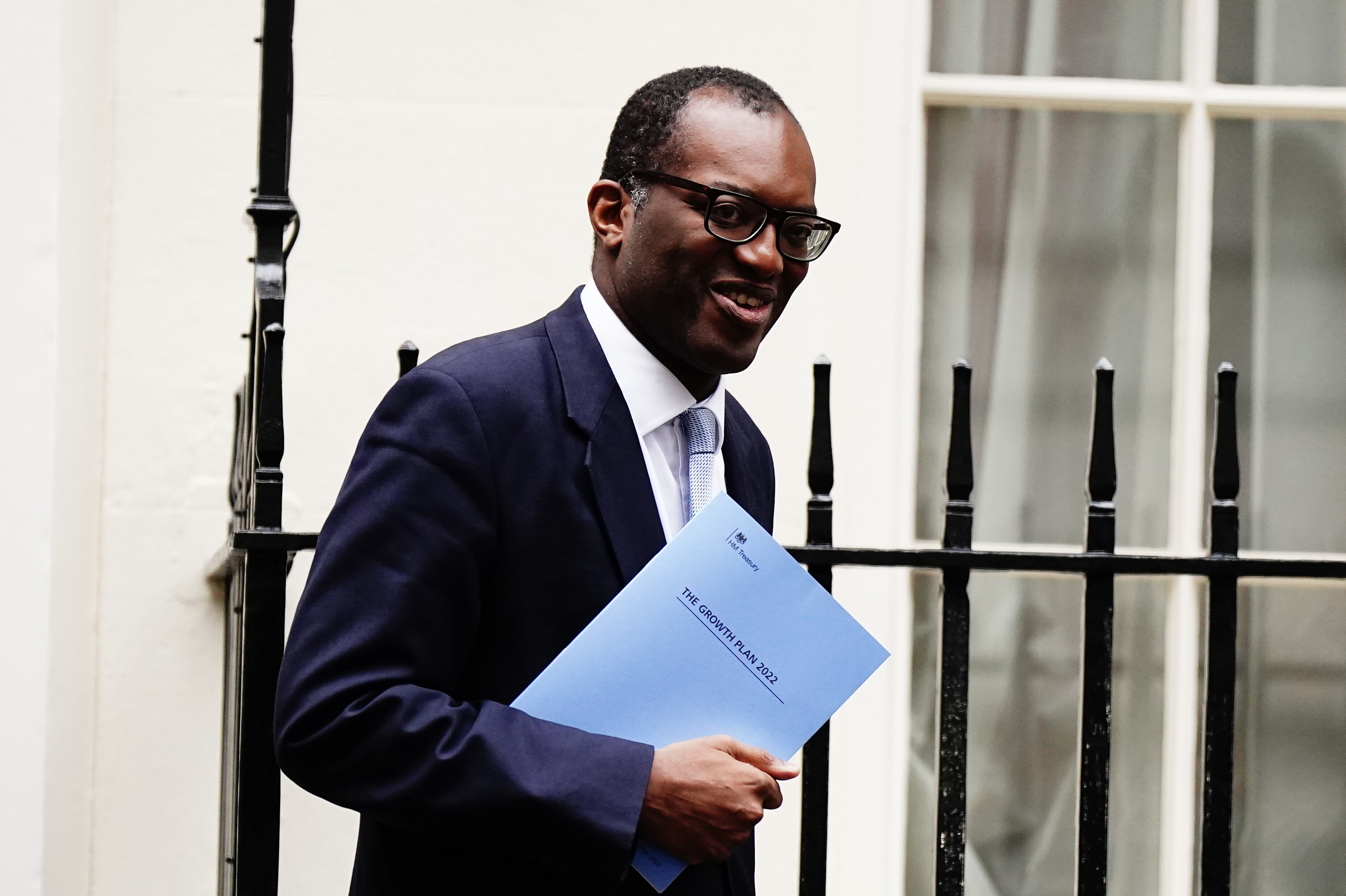

Kwasi Kwarteng’s plan to boost growth “looks set to fail”, the Tony Blair Institute has said.

The chancellor’s mini-budget will “pile on” higher debt interest but add less than 0.1 per cent to annual GDP growth by 2027, their damning assessment found.

The TBI also warned that the impact of Kwarteng’s tax cutting package on interest rates will raise the government’s cost of borrowing “significantly”.

Its report found that higher debt interest costs will add £82 billion to the £169 billion direct cost of the tax measures over the next five years.

This additional debt interest cost alone is worth almost twice the cost of the HS2 rail project, they said.

“Our forecast shows that the chancellor has torn up the fiscal rulebook to boost growth,” the TBI said.

“But even on those narrow terms the plan looks set to fail: the economy will only be 0.4 per cent larger by 2027–28 as a result of the tax cuts announced in the growth plan.”

The institute joined forces with Oxford Economics to “fill the gap” left by the absence of a forecast from the independent Office for Budget Responsibility [OBR].

Kwarteng has come under fire for preventing the OBR from making a forecast, usually produce alongside a fiscal event, sparking accusations that he is avoiding scrutiny.

The lack of OBR data means there is no independent analysis of whether the announcements breach the government’s existing budget rules or their impact on growth.

Kwarteng’s controversial fiscal event last Friday spooked markets and sent the pound crashing. Mortgage lenders have followed suit, suspending new deals amid fears over rapidly rising rates.

On Wednesday, the Bank of England announced an emergency intervention to calm the markets.

TBI’s chief economist Ian Mulheirn said: “Last week saw the biggest tax-cutting fiscal event for decades, explicitly framed as a macroeconomic growth plan. So it was particularly unfortunate that the government did not seek the OBR’s assessment of the claimed growth-enhancing benefits.

“Our forecast suggests that the plan will boost growth by less than 0.1 per cent per year between now and 2027-28.

“The additional tax revenue generated is likely to be only around £6 billion per year by 2027-28, a small fraction of the fiscal cost of the measures themselves, leaving a yawning fiscal deficit.

“The direct cost of the tax cuts will add £169 billion over the next five years, but by pushing interest rates significantly higher than they would have been, the tax giveaway will also pile on £82 billion in debt interest costs for the government over the same period. This additional debt interest alone is worth almost twice the cost of the entire HS2 rail project.

“Put plainly our forecast demonstrates that the government’s growth plan is all pain, little gain for the UK taxpayer and our economy.”

It comes after the International Monetary Fund [IMF] launched a stinging attack on the UK’s tax-cutting plans and called on Liz Truss to reconsider them to prevent stoking inequality.

The Washington-based fund said Kwarteng’s mini-budget risked undermining the efforts of the Bank of England to tackle rampant inflation amid the cost of living emergency.

Kwarteng has strongly defended the tax cuts and was due to meet with investment banks on Wednesday.

Related...

A Tory Peer Has Blamed The Economic Chaos On The Prospect Of Keir Starmer Becoming PM

A Tory Peer Has Blamed The Economic Chaos On The Prospect Of Keir Starmer Becoming PM International Monetary Fund Urges UK To Reverse Huge Tax Cuts. Here's Why It Matters

International Monetary Fund Urges UK To Reverse Huge Tax Cuts. Here's Why It Matters Economist Blasts The 'Raging Incompetence' Of Truss And Kwarteng

Economist Blasts The 'Raging Incompetence' Of Truss And Kwarteng Remember How Rishi Sunak Demolished Liz Truss' Economics In The Summer?

Remember How Rishi Sunak Demolished Liz Truss' Economics In The Summer? Chancellor Expected To Cut Spending In 'Coming Weeks', Tory MP Says

Chancellor Expected To Cut Spending In 'Coming Weeks', Tory MP Says